A year in the life of a brand: FutureBrand Index 2022

Last month saw the launch of this year’s FutureBrand Index.

If you haven’t already read the report, you can download it here. What’s more, you can also take advantage of the interactive tools available on our website to compare the Top 100 brands over the years, explore the key drivers by sector, or even score your own brand against the 18 dimensions of purpose and experience.

I can’t help but be biased but I do look forward to the FutureBrand Index to help me try and see the bigger picture with each and every year that passes.

This year, volatility is never far from the frame, as evidenced by the recurring use of the term in the PwC Global Top 100 – it’s been a ‘volatile’ year for businesses around the world, and that ‘volatility’ sets the scene for the list of brands that form the FutureBrand Index. (And if you’re keen on what might constitute an antidote, flick to page 41 of the report for the key drivers that ought to help your brand survive a looming recession).

Given that backdrop, it hardly seems as though the dust will ever settle, but now’s as good a time as any to take a deeper dive into the data so that I can share some of my own personal highlights – some of the data and insights lying beneath the surface that you might have missed.

A little bit of background

Now in its eighth year, the FutureBrand Index is a global perception study that researches PwC’s Global Top 100 Companies by market capitalisation and reorders them based on the strength of brand perceptions rather than financial strength.

Using a wide range of indicators, the FutureBrand Index offers a rigorous assessment of how to future-proof the world’s biggest businesses based on a global research sample of 'informed professionals' – business leaders, decision makers, market watchers.

This research demonstrates that organisations who top the FutureBrand Index have built brands that give their businesses a measurable competitive advantage – understanding how offers insights for every brand in every sector.

Without further ado, here’s what’s piqued my curious mind this year.

#1. What might it take to trump Technology brands?

PwC’s Top 100 depicts “the relentless growth and increasing dominance of Technology” in its own words.

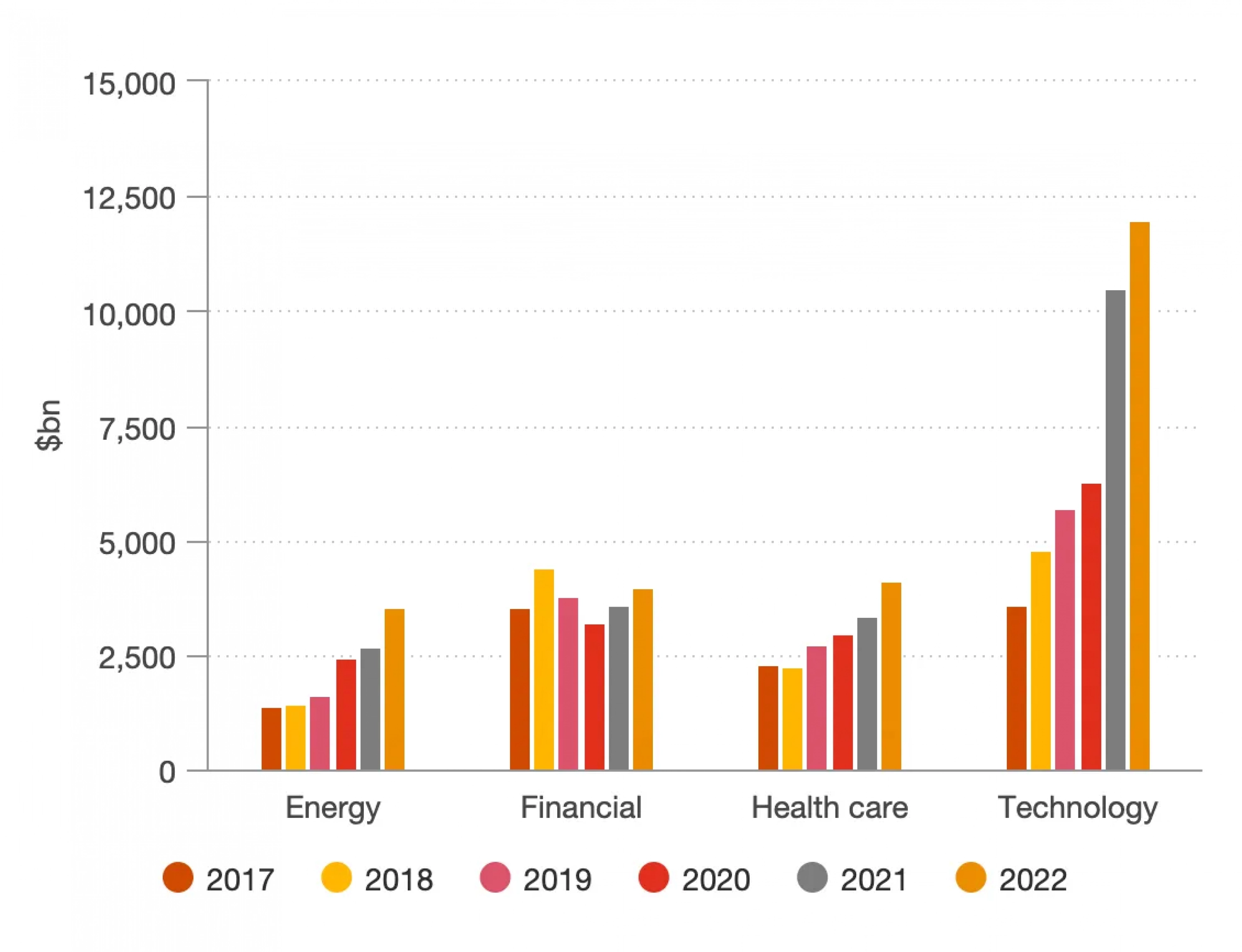

Just 20 Technology brands are responsible for 34% of the market capitalisation of the Top 100, and the Technology sector at large has seen its market capitalisation more than triple between 2017 and 2022, as shown below in no uncertain terms.

(Meanwhile, look at the Finance sector flatline in comparison, more on that later.)

Technology’s growth appears unassailable according to PwC and this is only amplified by the fact that the FutureBrand Index identifies technology adoption and integration as the number one threat to future success (page 40, if you’re interested in the top ten list of threats).

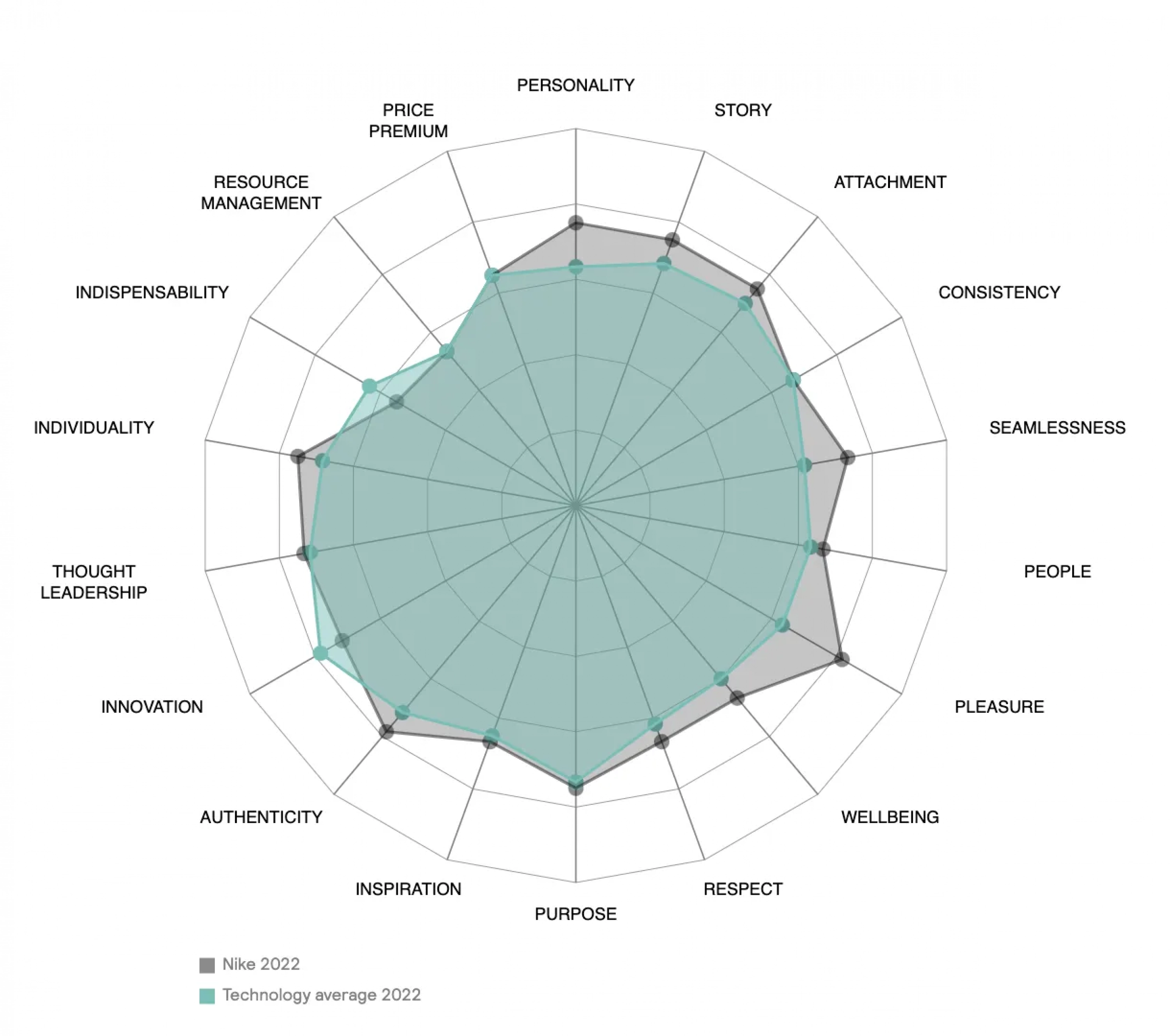

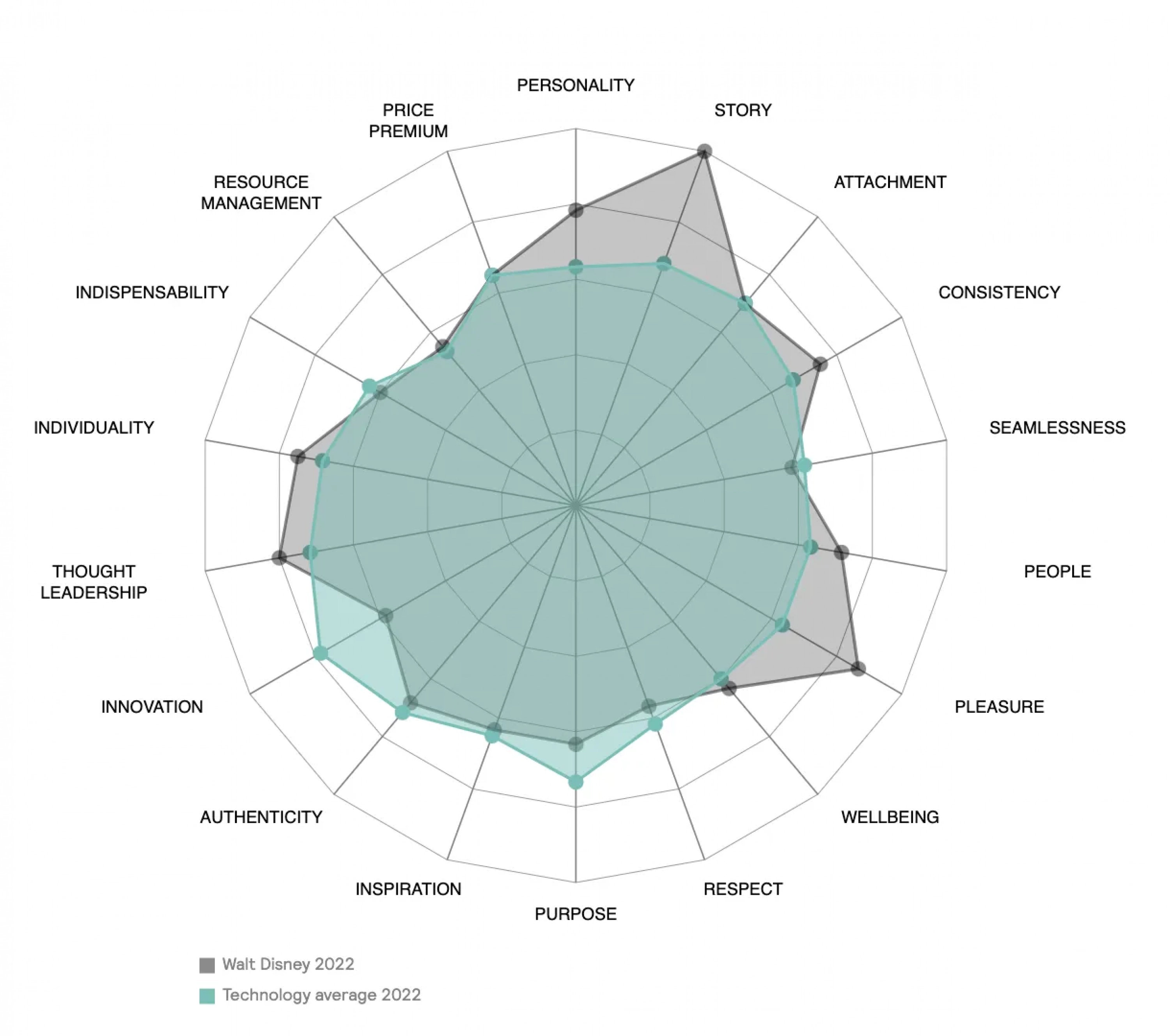

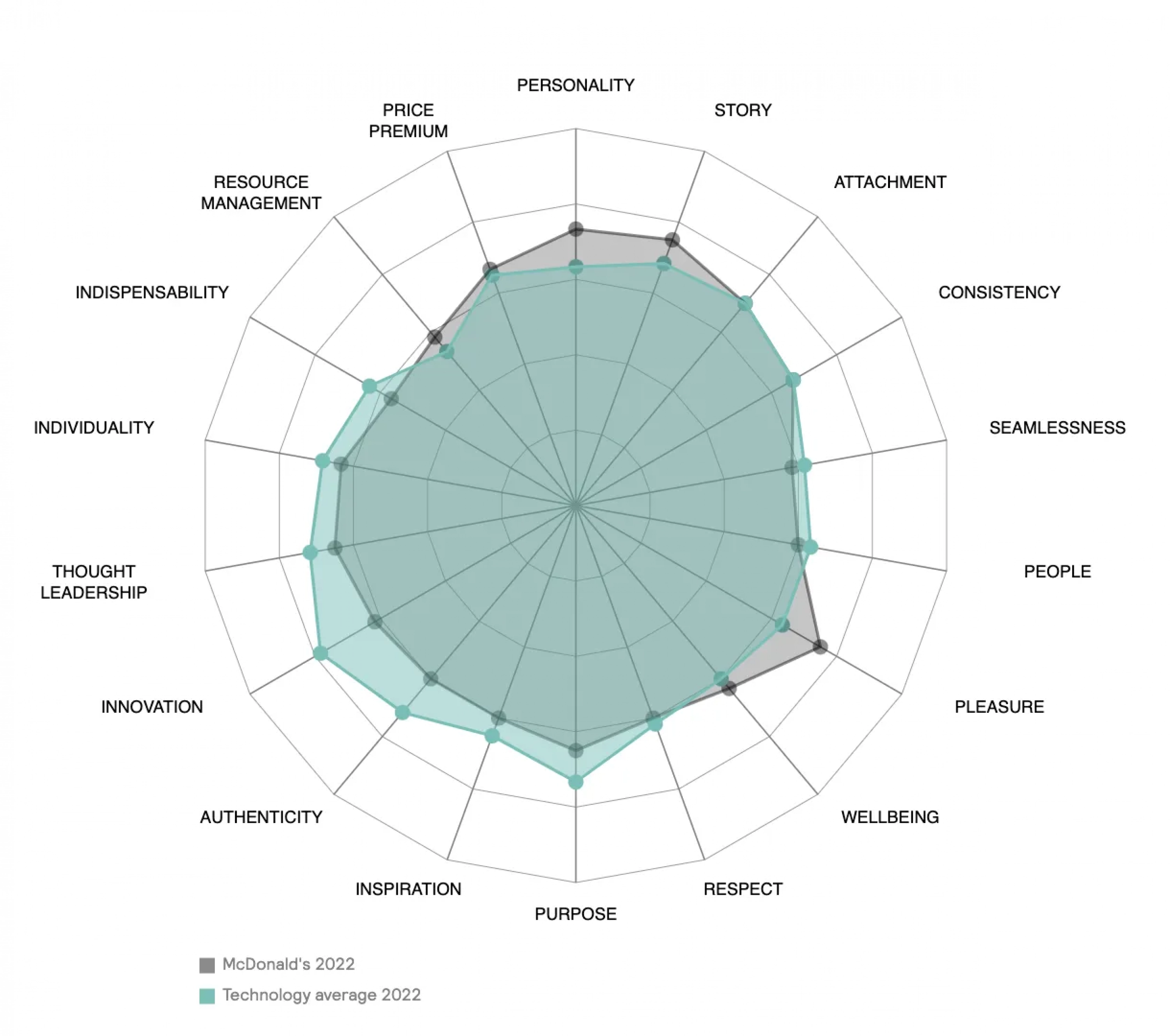

That said, the FutureBrand Index does reveal some useful insights into what it might take to trump technology. Here are the charts for three Consumer Discretionary brands that have embraced technology and, when compared against the average of the Technology sector, you can see they share some common strengths.

Here’s Nike…

Now Walt Disney…

And last but not least, McDonald’s…

…first, all three spike on Pleasure, underpinning these brands’ ability to have a positive impact in people’s lives.

And secondly, they also over-index on Personality and Story, both of which enable these brands to build a strong emotional connection with people.

What’s more, this isn’t simply about B2C brands, it’s equally relevant for B2B brands too. After all, we live in what I often describe as a ‘post-TEDx world’ in which business has never been more emotive and expressive.

So if you want to trump technology, you might want to consider how to add positivity, personality and storytelling to your brand and business.

#2. Can Finance brands make a difference?

Year after year, brands in the Finance sector lag the average of all others.

The chart above comparing market capitalisation by sector tells its own story of the Finance sector rebuilding post-GFC, but I can't help but think there's something else limiting those brands from reaching their full potential.

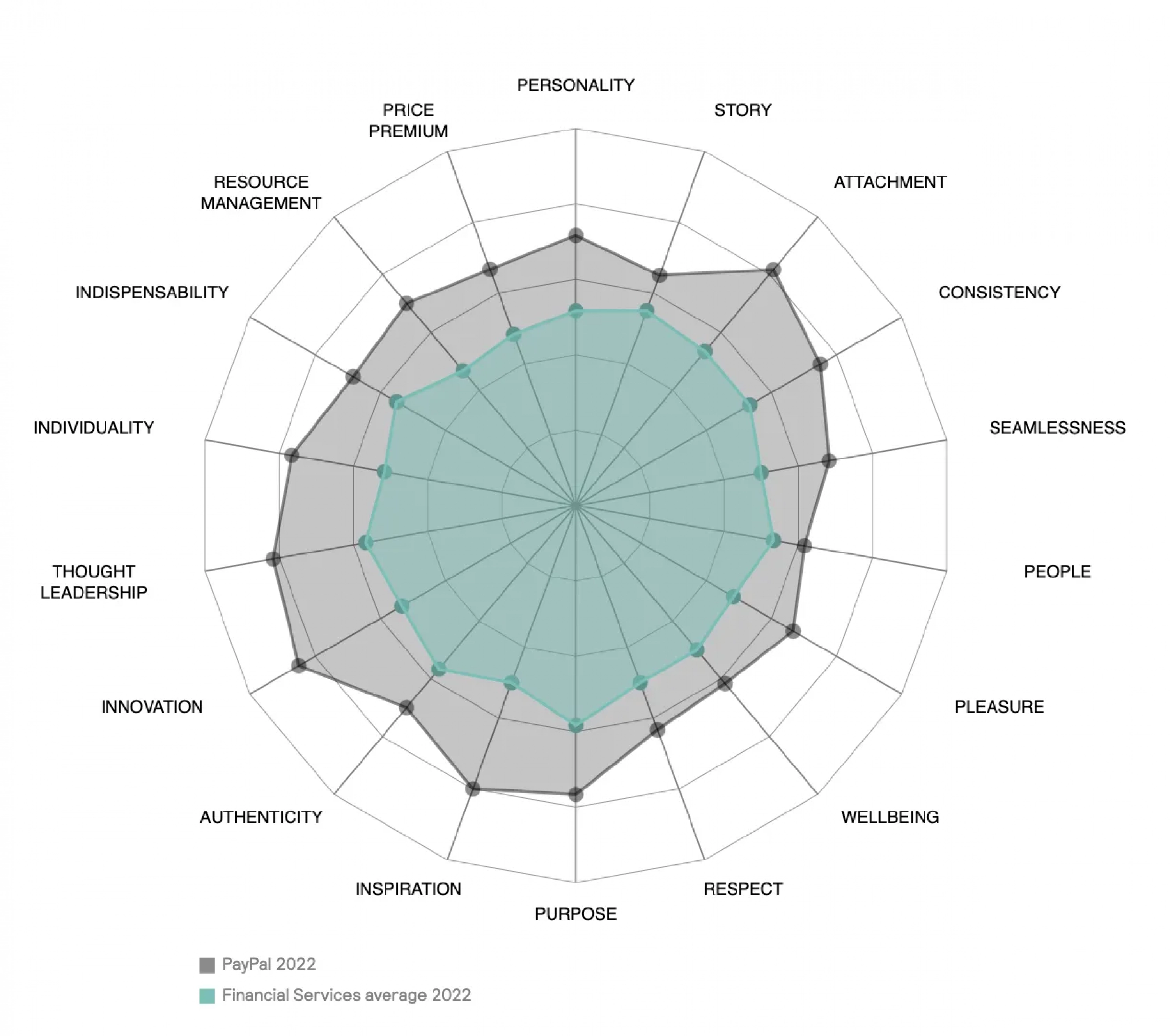

One of the quirks of the PwC list is that payments businesses like PayPal (plus Mastercard and Visa too) are listed in the Industrials sector now that their offer has expanded beyond the Finance sector to reach underbanked individuals, companies and governments. What this does is provide another insightful point of comparison, as shown below.

What stands out – quite literally – is PayPal's Individuality, Thought Leadership and Innovation, key dynamics which combine to enable brands to redefine their sector or at least make themselves distinctive from the competition.

What’s more, it suggests that all the energy, technology and resources thrown at building great experiences simply won’t stack up if it all feels so familiar as to be forgettable. It was Groove Armada who sang, ‘If everybody looked the same, we'd get tired looking at each other’ – the same can be said for all too many Finance brands, will yours be the exception?

#3. The clearer, the better

None of us have a crystal ball to predict the future, but it does seem that Mark Zuckerberg’s play for the metaverse is a winning stake in whatever the future may be.

While Meta Platform’s performance in this year’s Index has been described as “a surprising success story…following a much-debated rebrand in late 2021”, there are clues in the data as to what might have driven that success. Not necessarily by diving into Meta per se but rather by comparing it with Alphabet, the holding company created to house Google alongside its various iterations and innovations.

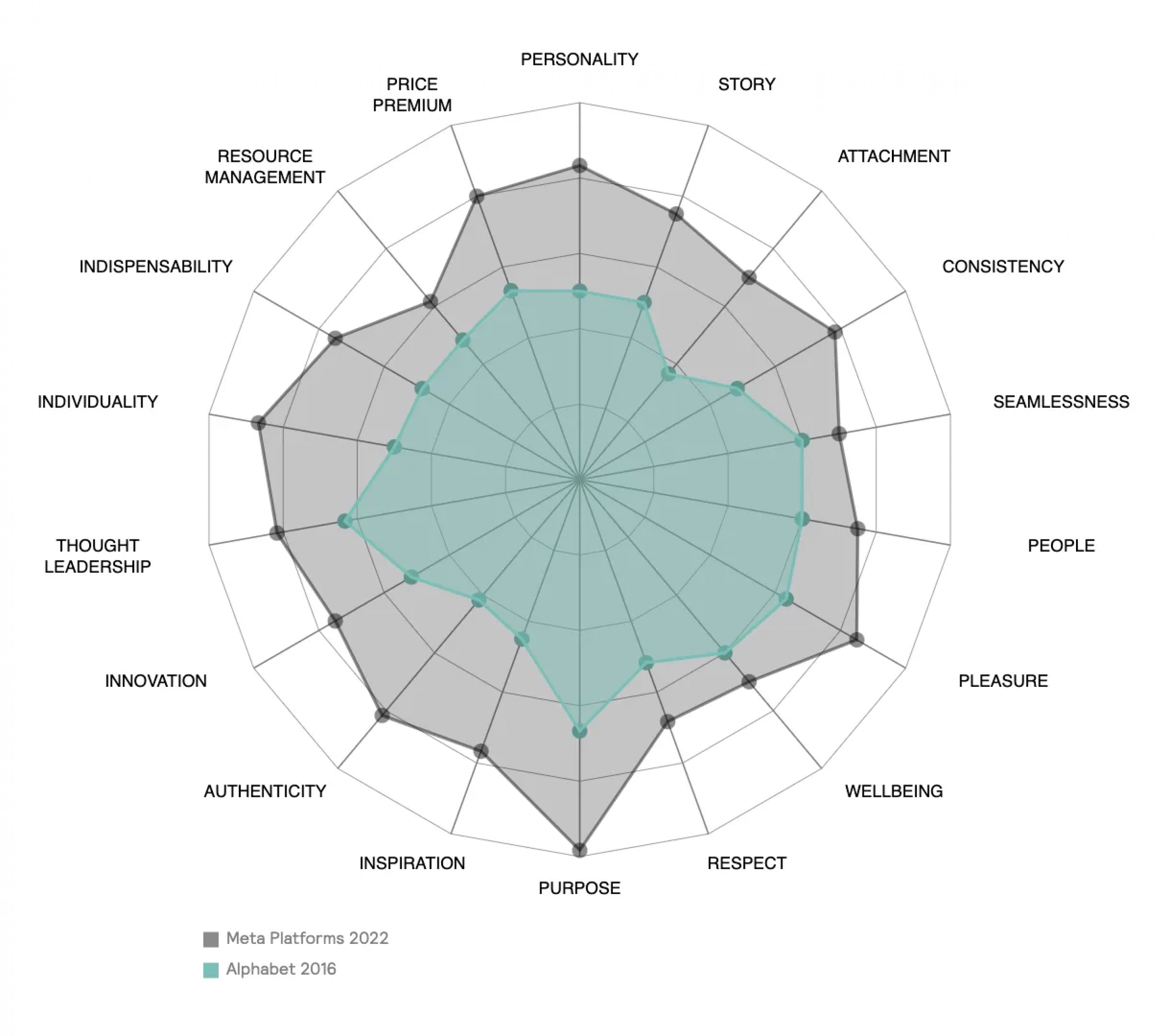

Here’s Meta now, compared with Alphabet when it first launched in 2016:

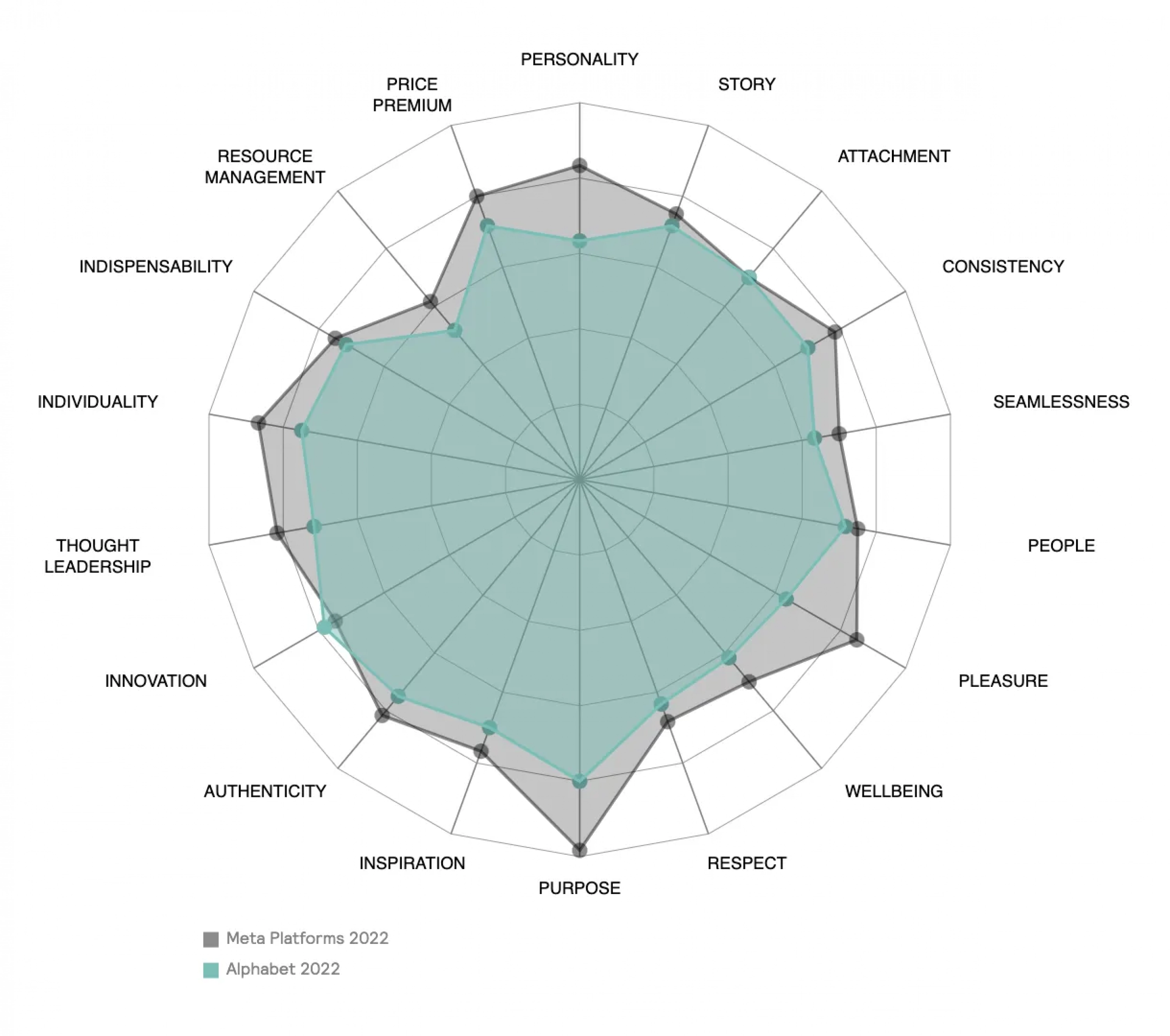

And here’s Meta compared with Alphabet in this year’s Index:

As you can see, perceptions of both brands take similar shapes but Meta outperforms on dimensions including Purpose, Pleasure, Personality and Individuality, all of which help Meta tell a story that is fundamentally so much clearer.

59% of the business leaders, decision makers and market watchers who form the research sample believe that Meta “has a clear sense of the future” – that’s the highest response to any brand on the Index.

And therein lies the difference.

Clarity.

In a world that seems to be growing ever more uncertain, brands that have that clarity of vision help people see their way towards the future.

#4. Is China faltering or maturing?

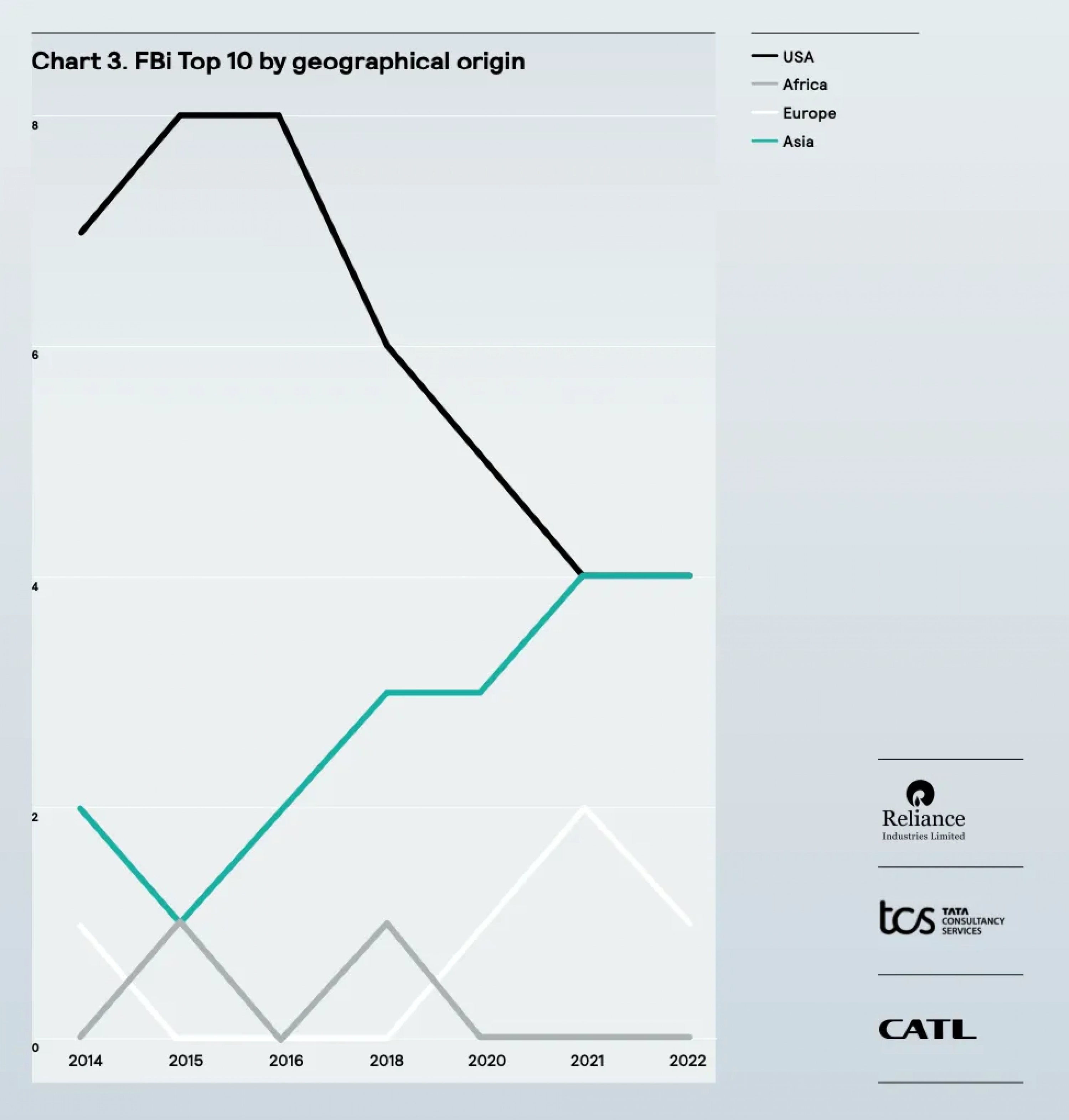

This year has seen the continued ascendancy of Asia with three of the Top Five companies hailing from the East, namely Reliance Industries, CATL and Tata Consultancy Services.

India and China in particular are vying for global prominence, but dig beneath the surface and you'll find that most brands from China experienced only modest rises and falls (with two notable exceptions, one being CATL, the other PetroChina, both closely linked to our energy future).

In and of itself, that might not look like much, but it could well mean more when taken in tandem with this perspective highlighted by PwC:

“Over the past ten years, changes in the market capitalisation of companies from China and its regions was broadly aligned with the US. In 2022 the value of the Global Top 100 companies from China and its regions decreased by 23%, in contrast companies from the US increased by 19%. Is this an indication of future de-coupling as the Chinese markets deepen in liquidity and mature?”

I wouldn't want to bet against brands from China but they will be ones to watch as the world of business continues to change shape as a consequence of geo-political dynamics.

#5. ESG is for real (although it’s still a riddle for some, a mystery to others)

Acronyms can sometimes feel so abstract but this year’s Index demonstrates that ESG is real.

What’s more, to put it into the most practical terms possible, this year’s Index reveals that E stands for Emissions – because ‘nothing matters more than reducing emissions’. And nowhere was that more overtly evidenced than just recently when Coles made the strategic decision to sell their fuel network to Viva Energy.

“Coles chief executive Steven Cain is getting out of petrol for a cleaner and greener image…said the transaction would allow it to focus on its key omnichannel supermarket and liquor businesses, and march towards his ambition of becoming Australia’s most sustainable supermarket group.” – Australian Financial Review

While the increasingly mainstream narrative around ESG carries conviction, the data reveals a slightly more tentative tale.

Across all Top 100 brands, 31% on average “strongly agree” with the statement that one brand or another “acts ethically to maintain a sustainable environment”.

But it’s also telling that 30% on average “neither agree nor disagree”.

And of the 55 brands that under-index of that same question, as many as 35% on average “neither agree nor disagree”.

Climate change is perceived to be the second biggest threat to future success, that much is true. But when it comes to ESG, all too often people simply do not know – that’s the harsh reality for now.

That said, a renewable energy brand NextEra is in pole position on this year’s Index, which would suggest a sense of optimism for the future is timely…for some further insights, feel free to revisit what I wrote on ESG back in August, titled ESG: Untangling the riddle wrapped in a mystery hidden inside an acronym.

I hope you enjoyed reading my own personal highlights from this year’s FutureBrand Index – and, of course, I hope you find not only those highlights useful but also the full report valuable too. You can read some further reflections in these interviews with SmartCompany and The Drum. As ever, I’m be happy to hear all and any feedback, so please do comment, subscribe and share.

Feel free to subscribe here for monthly news, views and insights.

Related articles

Green energy dominates FutureBrand Index, with Apple pushed out of the top five for first time

In SmartCompany's coverage of the FutureBrand Index 2022, green energy companies have topped this year’s FutureBrand Index, eclipsing the future-focused technology brands that dominated last year’s list, and pushing tech giant Apple out of the top five for the first time since the global study began.

Three things companies can do to think with diversity in mind

We’ve all heard the saying "great minds think alike" but have we stopped to think how much of this is true? If we all had the same ‘great’ mind, how great would that actually be?

ESG: Untangling the riddle wrapped in a mystery hidden inside an acronym

This year's Mumbrella Finance Marketing Summit featured Victoria Berry hosting panel discussion of experts on ESG.